In today’s complex regulatory environment, especially after Brexit, the significance of understanding and adhering to local laws cannot be overstated. The departure of the UK from the EU has introduced new challenges in legal compliance, particularly for businesses in the construction, telecoms, and IT sectors that operate across borders. Navigating this new landscape requires not only an in-depth understanding of the varied tax systems but also a strategic approach to compliance.

Let’s explore how our expertise in local tax laws across Europe not only benefits our operations but also adds significant value to our clients.

iCobus’s Expertise in Navigating Tax Laws

In the specialised field of structured cabling and related services, understanding and complying with specific tax laws is crucial for our operations at iCobus. Our 25-year journey has equipped us with the expertise to navigate these complexities, particularly in the European context where tax laws vary significantly by country. Here are some examples:

VAT Compliance in Multi-Country Projects

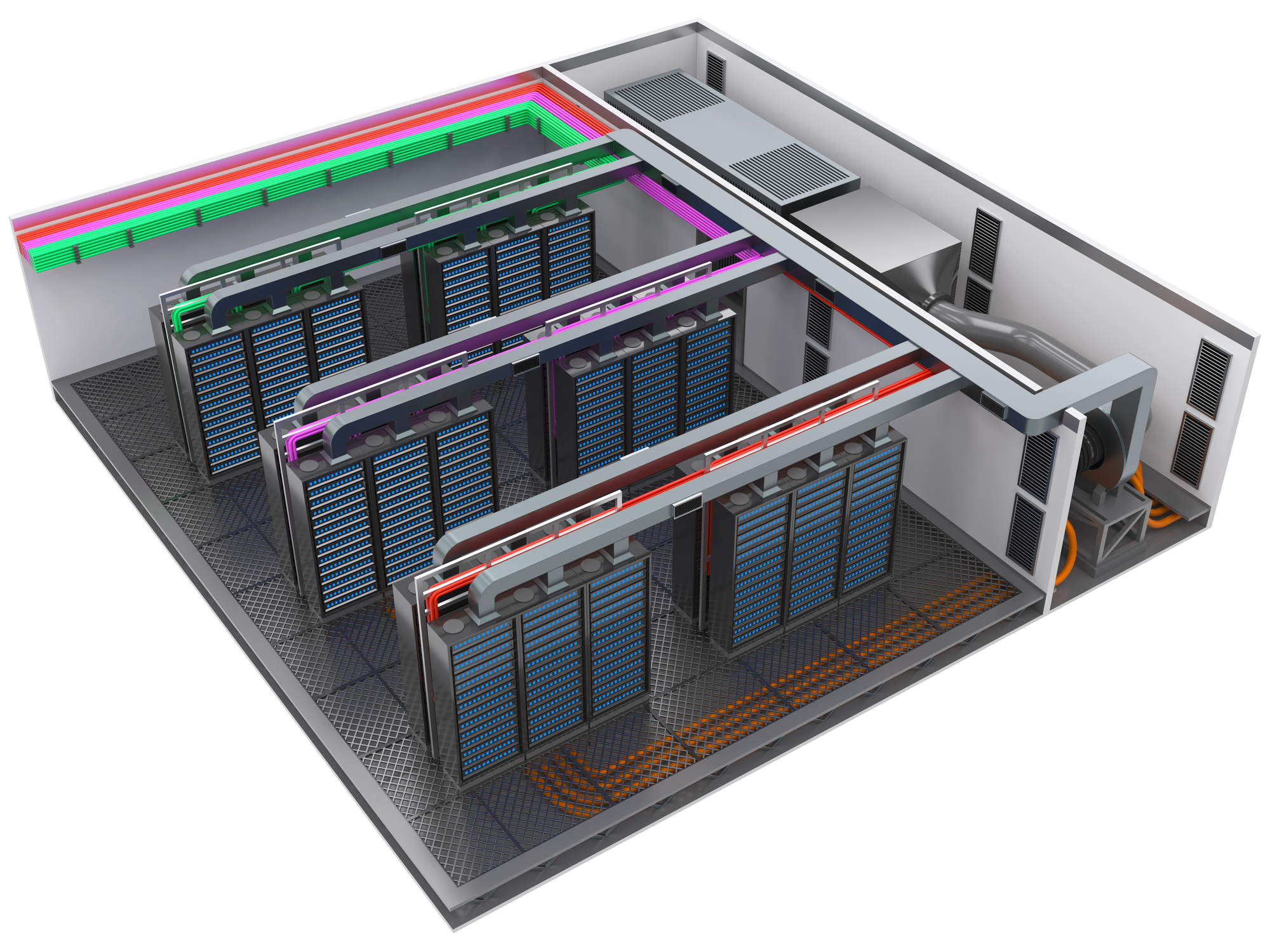

Germany and Sweden Data Centre Project: For a network cabling project involving sites in both Germany and Sweden, we navigated complex VAT rules (VAT rates of 19% in Germany and 25% in Sweden). This required in-depth knowledge of the EU’s VAT Directive, which allows member states to set their standard VAT rates with the only condition that it must be above 15%.

Denmark Structured Cabling Project: While working on a major Data Centre project in Denmark, we navigated a number of regulations including the Danish VAT Act, which includes a standard VAT rate of 25%. The Danish tax law is known for its comprehensive documentation requirements, making it essential for to ensure all invoices, records and right to work were compliant with the Danish regulations.

Our long-standing experience has been key to understanding these intricate local regulations. In the structured cabling sector, where the precision of financial and technical aspects is paramount, staying abreast of the latest tax regulations in each operational country ensures our projects are not just technically proficient but also financially and legally sound.

Training and Professional Development

We firmly believe that continuous training and professional development are pivotal to staying compliant, especially in an industry as dynamic as structured cabling and data infrastructure. Our commitment to ongoing education ensures that our team is not only technically proficient but also well-versed in the latest tax laws and regulations.

Role of Continuous Training

We regularly engage in training programs offered by reputable institutions like CNet Training, Fluke Networks, and BICSI. These programs are crucial for keeping our team updated on the latest industry standards and practices.

For example, CNet Training’s programs focus on the latest technologies and installation practices in network cabling, which is a core area of our expertise. This is vital in an industry projected to grow at a CAGR of 10% by 2028, as per Grand View Research.

Additionally, the intricacies of Fluke Networks’ Cable Analyser Testing are a staple in our training modules, ensuring our team is adept at using cutting-edge tools for quality assurance in cabling infrastructure.

Ensuring Staff Knowledge on Tax Laws and Regulations

Keeping abreast of tax laws and regulations is a continuous process at iCobus. We conduct regular training sessions and workshops to update our staff on the latest tax legislation in the countries we operate in. This is particularly important in the EU, where VAT rates and regulations can vary significantly between member states.

We leverage resources like the OECD’s Tax Database, which provides detailed insights into various tax regimes, to educate our team.

This approach is instrumental in a market where, according to Global Market Insights, the data centre construction sector is expected to reach USD 32.50 billion by 2032, signifying the scale and complexity of the projects we undertake.

Our training and development initiatives are designed not just to maintain compliance but to foster a culture of excellence and continuous learning. By investing in our team’s growth, we not only enhance our service quality but also reinforce our reputation as a trusted, knowledgeable partner in the structured cabling and data infrastructure industry.

Partnerships and Collaborations

When it comes to structured cabling and data infrastructure, ensuring compliance extends beyond internal expertise at iCobus. Our approach includes forming strategic partnerships and collaborations, particularly with payroll companies and legal experts, to navigate the multifaceted compliance landscape across 17 different countries effectively.

Partnerships with Payroll Companies and Legal Experts

We collaborate with specialised payroll companies that are well-versed in the varying tax and employment laws of different European countries. These partnerships are crucial for ensuring that our workforce is managed in compliance with local tax laws, a complex task given the variety of VAT rates and employment regulations across Europe.

For instance, dealing with the intricacies of the Danish VAT Act, which demands comprehensive documentation, is made efficient through these collaborations.

Our partnerships with legal experts, particularly those specialising in EU tax and labour laws, play a critical role. These legal teams provide us with timely updates and in-depth analyses of the evolving legal landscape, especially in a post-Brexit Europe where regulatory changes are frequent.

Benefits for Clients

iCobus’s expertise in tax law compliance is not just an internal achievement; it brings tangible benefits to our clients, enhancing the value and security of the services we provide.

Added Value Through Tax Law Compliance

- Our deep understanding of European tax laws means that clients receive services that are not only of high technical quality but also legally sound. This comprehensive approach is especially crucial in sectors like structured cabling and data infrastructure, where compliance is as important as technical execution.

- By managing the complexities of tax compliance, we enable our clients to focus on their core business activities without the burden of legal intricacies.

Risk Mitigation and Assurance of Legal Compliance

- Our approach significantly reduces the risk of legal non-compliance for our clients. This risk mitigation is crucial, considering that non-compliance in tax and labour laws can lead to hefty fines and legal disputes.

- We provide an assurance of legal compliance, which is a critical factor for businesses operating across different European countries. This assurance is backed by our strategic partnerships with payroll companies and legal experts, ensuring that every aspect of our service meets the requisite legal standards.

Client Testimonials on Compliance Support

Our clients consistently acknowledge the peace of mind our compliance expertise brings to their projects.

One client, a major player in the telecom industry, commended iCobus for our “meticulous adherence to tax regulations”, which played a vital role in the smooth execution of a multi-country data centre project.

Another client in the IT services sector highlighted our “proactive approach to legal compliance”, emphasising how this attention to detail ensured their project remained on schedule and within budget, without any legal hurdles.

At iCobus, we view our commitment to tax law compliance as a fundamental component of our service offering. It not only enhances our operational excellence but also provides our clients with a level of service that is both technically and legally robust, setting us apart in the structured cabling and data infrastructure industry.

Future Outlook and Commitment

As we look towards the future at iCobus, our commitment to staying at the forefront of changing tax laws and regulations across Europe remains unwavering. This commitment is not just a part of our business strategy; it is a core principle that guides every project and decision we make.

Adapting to Changing Tax Laws and Regulations

We are dedicated to continuously monitoring and adapting to the evolving tax landscape in Europe. This adaptability is crucial in a market where legal frameworks are not static, particularly in the aftermath of events like Brexit. Our agility in this area ensures that we are always providing services that are not only compliant but also optimised for the current legal environment.

Investment in Technology and Training

We are committed to ongoing investment in both technology and training to ensure sustained compliance. We leverage the latest tools and software to keep our services cutting-edge and compliant with legal standards. Simultaneously, our investment in training ensures that our team is knowledgeable about the latest developments in tax laws and industry best practices.

The Importance of Compliance in the Current Market

In the current European market, compliance is not just a legal requirement; it is a competitive advantage. Our focus on compliance assures our clients that they are partnering with a company that understands and respects the importance of legal and regulatory adherence in every aspect of our operations.

Clients navigating the complexities of structured cabling and data infrastructure in Europe, iCobus stands ready to be your trusted partner.

Our expertise in tax law compliance, coupled with our technical proficiency, ensures that your projects will be managed with the utmost professionalism and legal integrity. We encourage you to reach out to us to discuss how we can support your compliant labour and managed service needs.

Contact us today to learn more about how our services can benefit your business.

You May Also Like

Every connected system, from offices to data centres, depends on the skill of the people who install and maintain its cabling. The role of the cabling engineer has evolved far beyond pulling cable and crimping connectors. It now blends technical knowledge, safety awareness, and precision workmanship.

Modern ICT environments demand engineers who can think system-wide, work to strict standards, and adapt to new technologies as they emerge.

1. Technical understanding across copper and fibre

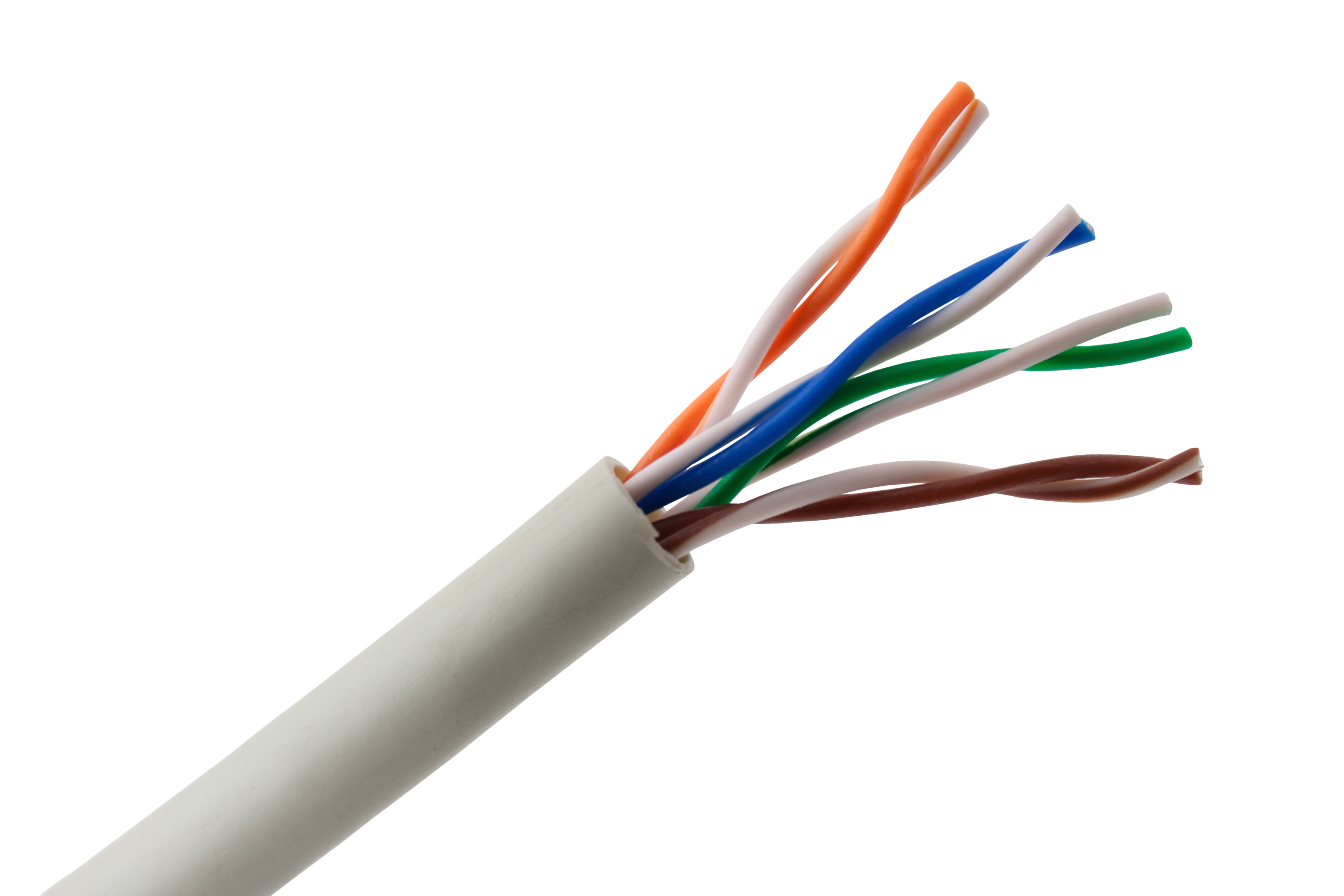

Cabling engineers are expected to understand both copper and fibre systems in detail. This includes how each medium behaves, where to use them, and how to terminate, test, and document installations correctly.

Cat6a, OM4, and single-mode fibre are now standard in many projects, and engineers must know how to work with them safely and efficiently.

2. Certification and compliance knowledge

The best engineers work within established frameworks such as ISO/IEC 11801, EN 50173, and BS EN 50600. They understand what compliance means in practice and how to document installations for testing and handover.

Holding ECS or CSCS accreditation is essential for access to most UK sites, while BICSI and manufacturer-specific training further enhance credibility.

3. Attention to safety and site discipline

Working safely is fundamental in ICT infrastructure. Cabling engineers handle tools, lifts, and occasionally electrical equipment. Awareness of risk assessments, method statements, and site-specific safety protocols keeps both the team and the installation protected.

4. Precision and workmanship

Modern data and power systems rely on connections made with millimetre accuracy. Poor terminations, incorrect bend radius, or loose patching can reduce performance and create costly faults. Skilled engineers take pride in the neatness, organisation, and reliability of their work.

5. Adaptability and continuous learning

Technology never stands still. Engineers now work on systems that support PoE, Wi-Fi 7, and smart building automation. Staying current through ongoing training ensures installations meet new power, data, and sustainability demands without compromising safety or performance.

6. Communication and coordination

Cabling engineers rarely work in isolation. They coordinate with project managers, electricians, M&E teams, and IT specialists. Clear communication ensures containment, routing, and scheduling align smoothly across trades.

7. Documentation and testing accuracy

Testing is not the end of the job; it is part of the job. Engineers who can produce complete, accurate test reports and maintain clear labelling help prevent downtime and simplify maintenance. Strong documentation is the mark of professional work.

8. Professional pride and accountability

What separates a capable engineer from a great one is care for the end result. Every rack, tray, and termination reflects the quality of the team behind it. Attention to detail, respect for standards, and ownership of outcomes build both personal and client trust.

Modern cabling engineers are the quiet force behind digital infrastructure. Their skill, training, and precision keep systems performing day after day. As connectivity expands and technology advances, the demand for high-quality engineering will only grow - and with it, the value of those who keep the networks running.

When it comes to structured cabling, pricing can vary widely from one quote to another. The difference is rarely about the cable alone. Real costs are shaped by design complexity, site conditions, labour, testing, and compliance requirements.

Understanding how these factors fit together helps you compare proposals confidently and make informed decisions that balance performance with value.

1. Materials and specification

Cable type is the starting point, but it is only one piece of the cost equation. Cat5e remains suitable for basic voice or data systems, while Cat6 and Cat6a are now standard in most commercial projects. Fibre optic cabling adds greater reach and bandwidth but involves more specialist terminations and testing.

Additional materials such as patch panels, containment, and fixings can represent a significant share of total cost. Projects that require LSZH (low smoke zero halogen) or fire-rated cables may also have higher material prices.

2. Labour and installation

Installation labour is typically the largest single cost in a structured cabling project. Time requirements depend on access conditions, ceiling height, containment design, and whether work takes place in an occupied environment.

Working out of hours or in secure areas often increases labour costs due to restricted access or additional safety requirements. Skilled technicians with ECS or CSCS accreditation ensure installation meets both technical and health and safety standards.

3. Containment and cable routing

Containment design influences both time and material costs. Surface-mounted trays or baskets are usually more cost-effective than hidden routes within ceiling voids or raised floors. In data centres, where density and cooling matter, containment systems are often bespoke and can represent a large portion of total cost.

4. Testing and certification

Every installed cable must be tested to verify performance. Certification using equipment such as Fluke DSX or OTDR testers confirms compliance with ISO/IEC and EN standards. Testing adds time but protects both client and contractor by ensuring system reliability and reducing future rework.

Detailed test reports are typically included as part of project handover and should always be factored into pricing.

5. Site conditions and logistics

Active sites, restricted access, or limited working hours can affect project efficiency. The need for temporary power, scaffolding, or additional equipment increases both labour time and cost. Projects in central London or other high-security areas often include higher logistical overheads due to permit, parking, and access controls.

6. Documentation and quality assurance

Professional cabling installations include full documentation: as-built drawings, test results, and labelled layouts. Producing and verifying these deliverables takes time but adds measurable value by simplifying future maintenance and upgrades.

7. Long-term value

Choosing the lowest upfront quote does not always provide the best result. Poor workmanship or incomplete testing can lead to downtime, rework, and unplanned costs later. Transparent quotes that outline materials, labour, testing, and exclusions offer the clearest picture of real value.

Structured cabling costs are shaped by many factors, not just cable price. Understanding what drives those costs helps you plan projects more accurately and set realistic budgets.

Get in touch today to discuss your next project.

Every network tells a story. Some were built when Cat5e was the top standard. Others now run Cat6a or fibre to support growing data demands. Each reflects the technology of its time, and together they show how network infrastructure continually adapts to new ways of working.

Upgrading today is not about replacing what came before. It is about extending, reinforcing, and preparing your infrastructure to support what comes next.

1. The foundations still matter

Legacy cabling systems remain the backbone of many reliable networks across offices, campuses, and industrial sites. When properly maintained and tested, Cat5e and Cat6 systems can still deliver strong performance for voice, data, and IoT devices. The focus for most businesses is not full replacement, but finding the balance between existing capability and future growth.

2. The data load is growing faster than ever

The number of connected devices, cloud applications, and high-resolution systems has multiplied. Modern cabling standards such as Cat6a and OM4 fibre are being introduced not only for faster speeds, but also for stability under heavier traffic and power requirements. Many networks now blend copper and fibre to achieve both reach and efficiency.

3. Upgrades are becoming more strategic

Full-scale cabling replacement is rarely necessary. Most organisations are adopting a phased approach, upgrading critical links, improving backbone connections, and adding higher-grade terminations in key areas. This targeted strategy reduces downtime and cost while improving performance where it matters most.

4. Power delivery is changing how systems are designed

Power over Ethernet (PoE) is now used to run everything from lighting and security systems to access points and digital displays. This requires cabling that can safely carry both data and power without overheating. New installations often include mixed cable types rated for higher power classes, while older runs can remain in place for lighter loads.

5. Fibre is extending the limits of copper

Fibre is no longer used only for large data centres. It is becoming common in office buildings, education facilities, and multi-floor environments where longer runs are needed. Fibre backbones paired with copper horizontal links allow networks to scale seamlessly without disruption to end users.

6. Standards and certification continue to evolve

ISO/IEC 11801 and EN 50173 updates ensure that both old and new systems can interoperate. Following these standards when designing or upgrading a network maintains compatibility, simplifies testing, and provides assurance that performance targets will be met.

7. Sustainability is influencing upgrade decisions

Modernisation is no longer only about speed. Reusing existing containment, racks, and patch panels reduces waste and project costs. Sustainable cabling choices such as low-smoke, halogen-free (LSZH) materials are becoming standard across public and commercial projects.

The best networks are not built from scratch each decade. They evolve. Businesses that plan upgrades around growth, compatibility, and energy efficiency gain long-term reliability without unnecessary disruption. Whether your next step involves fibre integration, higher-category copper, or improved containment, the goal remains the same: building a foundation that supports connection today and tomorrow.

Get in touch today to discuss your next project.

AI and automation are reshaping how data centres are designed and built. The change is not only about faster processors or denser hardware, but about how well the underlying cabling infrastructure can handle the data volumes, power demands, and thermal loads these systems create.

Structured cabling is moving from a background utility to a core enabler of performance and scalability. Over the next few years, several clear trends will define how cabling strategies evolve for AI-driven environments.

1. Higher bandwidth and lower latency will set the baseline

AI workloads require massive data transfers between compute nodes and storage systems. To support this, multi-mode fibre such as OM4 and OM5 and high-performance Cat6a or Cat8 copper will become essential for maintaining low-latency, high-speed connectivity. The focus will shift toward designing link paths that minimise loss and future-proof the network.

2. Power and cooling constraints will shape cabling routes

AI servers draw significantly higher power than traditional hardware, which increases heat output. Cabling layouts will need to evolve around more complex airflow patterns and containment systems. Expect more segregated pathways, underfloor cooling integration, and materials rated for higher ambient temperatures.

3. Smarter cable management will drive operational efficiency

As rack densities increase, the ability to service or upgrade systems without downtime will depend on structured cable routing, clear labelling, and accessible patching. Intelligent cable management systems that monitor utilisation and temperature will likely see wider adoption to improve both reliability and maintenance.

4. Testing and verification will become more data-driven

At higher transmission speeds, even minor inconsistencies can affect performance. Testing will shift from one-time certification to continuous monitoring using automated diagnostic tools. Real-time test reporting and predictive fault detection are expected to become standard practice in large-scale facilities.

5. Fibre growth will accelerate, but copper will retain key roles

Fibre will continue to dominate backbone and high-bandwidth interconnects, while copper will remain vital for shorter, power-efficient links. Hybrid infrastructures that combine both will become the norm, balancing performance, cost, and flexibility.

6. Flexibility and modularity will define future design

As AI architectures evolve, cabling systems will need to adapt quickly. Modular containment, quick-connect fibre panels, and pre-terminated assemblies will enable faster scaling and simpler reconfiguration as new technologies emerge.

7. Collaboration between disciplines will increase

Cabling design will continue to move closer to the core of mechanical and electrical planning. Expect greater integration between ICT, electrical, and cooling teams during early project stages to ensure performance goals are met across the entire environment.

AI is changing how data centres are planned, but the foundation remains the same: a reliable, scalable cabling network that can handle tomorrow’s demand. The companies that invest now in forward-looking infrastructure will be ready for the next generation of computing, where performance and adaptability are no longer optional but expected.

Get in touch today to discuss your next project.

If you are planning an ICT upgrade or new installation, you have probably come across a range of technical terms and industry jargon. This guide collects the most common structured cabling questions our clients ask and explains them clearly so you can plan with confidence.

1. What is structured cabling?

Structured cabling is the organised system of cables, patch panels, and hardware that connects all devices in a building or network. It supports everything from computers and Wi-Fi access points, to CCTV and VoIP systems.

2. Why is structured cabling important?

A well-designed cabling system improves performance, simplifies maintenance, and reduces long-term costs. It allows your business to scale without constant rewiring or downtime.

3. What are the main types of network cables?

The most common are:

- Cat5e – entry-level option for small offices or legacy systems

- Cat6 – standard for modern networks up to 1 Gbps

- Cat6a – supports up to 10 Gbps and ideal for data-heavy environments

- Fibre optic – used for long distances and high-bandwidth applications such as data centres or core network links

4. What standards should my cabling comply with?

Look for compliance with ISO/IEC 11801, EN 50173, and TIA-568. These international standards ensure your network meets performance, safety, and interoperability requirements.

5. How long does a structured cabling installation take?

Project duration depends on size and site conditions. A small office fit-out may take one to two days, while a large-scale data centre installation could take several weeks including design, containment, and testing.

6. How do I know if I need to upgrade my current cabling?

If you experience frequent network drops, slow transfer speeds, or you are adding high-bandwidth devices, an upgrade may be due. Systems support different types of technologies.

7. What is the difference between copper and fibre cabling?

Copper cables (Cat5e, Cat6, Cat6a) use electrical signals and are best for short to medium distances. Fibre uses light to transmit data and can carry more information over longer distances with less interference.

8. What is Power over Ethernet (PoE)?

PoE allows both power and data to run through a single Ethernet cable. It is commonly used for cameras, access points, and smart building devices, reducing the need for separate power cables.

9. How often should cabling be tested or re-certified?

Testing should always be carried out after installation. Re-certification every three to five years ensures ongoing performance and helps identify wear, corrosion, or accidental damage.

10. What should I look for in a cabling contractor?

Choose installers with ECS or CSCS accreditation, experience in structured cabling, and strong references. Ensure they provide full test results, documentation, and ongoing support options.

Understanding these core cabling questions helps you make informed choices about materials, standards, and suppliers. A reliable network starts with the right design and the right partner.

Contact us today to request a tailored quote for your site.

When planning a new ICT or structured cabling project, the first decisions you make will shape performance, compliance, and cost for years to come.

Whether you are upgrading an office, fitting out a data centre, or expanding your network backbone, these 10 questions will help you set the right foundation and choose the right delivery partner.

1. What standards should the installation comply with?

Ask your supplier which structured cabling standards they follow (ISO/IEC 11801, EN 50173, TIA-568). Compliance ensures your system meets recognised performance and safety benchmarks.

2. Is the design fully tested and documented?

Every professional installation should include as-built drawings, test certificates, and a labelling scheme that makes future maintenance simple.

3. What type of cable best suits my environment?

Copper (Cat6 or Cat6a) remains cost-effective for most office runs, while fibre is ideal for long distances and high-bandwidth environments.

Ask your contractor to explain the trade-offs between copper and fibre, and how each affects cost and scalability.

4. How do you manage containment and cable routes?

Poor containment design can cause airflow, density, and access issues later on. Confirm how containment will be handled, from tray layouts to segregation of power and data.

5. How is downtime minimised during installation?

If your network must stay live, make sure there is a phased installation plan with clear change controls and out-of-hours options to avoid disruption.

6. What testing and certification equipment do you use?

A credible installer should test every link using calibrated equipment such as the Fluke DSX series. Request copies of test reports as part of the handover.

7. Are your engineers certified and security cleared?

Look for ECS or CSCS cardholders with vendor or BICSI certifications. If the site is secure or critical, confirm engineers hold valid security clearances.

8. What is included in your quote and what is not?

Ask for a detailed quote that breaks down materials, labour, terminations, patch panels, and testing. Clarify exclusions such as containment, patch leads, or working at height.

9. How do you handle change requests or variations?

Scope changes are common. A transparent variation process keeps budgets under control and ensures quality is maintained.

10. What maintenance and support options exist after installation?

Structured cabling is a long-term asset. Check whether your provider offers ongoing support, re-testing, and system upgrades to keep the network performing optimally.

Structured cabling might seem invisible once installed, but it is the foundation every device, system, and application depends on.

Asking the right questions early protects your investment and ensures the infrastructure you build today remains reliable tomorrow.

Contact us today to request a tailored quote for your site.

Even the best equipment cannot perform well if the cabling behind it is installed incorrectly. Small mistakes during installation can cause big performance issues later, from signal loss to network downtime.

Here are the ten most common structured cabling mistakes and how to prevent them through planning, training, and proper standards.

1. Using the wrong cable category

Choosing the right cable type is essential for long-term performance. Installing Cat5e in a system that requires Cat6a can limit bandwidth and make future upgrades more expensive. Always confirm the network speed and distance requirements before purchasing or installing cable.

2. Poor separation between power and data

Running network cables too close to electrical lines can cause electromagnetic interference. Always follow spacing guidelines and, when necessary, use shielded cables or separate containment to maintain performance.

3. Over-tight cable bends and tension

Pulling cables too hard or bending them sharply can damage the internal structure and degrade signal quality. Follow the manufacturer’s bend radius limits and use cable management to maintain neat, consistent routing.

4. Untidy or unlabelled patch panels

An unlabelled patch panel might not cause immediate problems, but it complicates maintenance and troubleshooting. Use clear, permanent labels for every port and maintain updated documentation for all cabinet layouts.

5. Skipping cable testing or certification

Every installed link should be tested for continuity, attenuation, and performance using calibrated testers such as Fluke. Test certificates provide assurance that each link meets specification and reduce disputes after handover.

6. Ignoring containment planning

Poorly planned containment often leads to congestion, overheating, and blocked airflow. Plan containment routes early in the design phase and allow space for future capacity.

7. Mixing different cable types without planning

Combining copper and fibre, or mixing different categories of copper, can create inconsistent performance and testing results. Always document transitions and ensure patching equipment supports the intended mix.

8. Failing to maintain bend radius in patch leads

Patch leads are often overlooked, yet sharp bends near connectors can lead to signal degradation. Use Velcro ties instead of plastic cable ties to avoid crushing or deforming cables.

9. Poor grounding or bonding

Improper grounding increases the risk of interference and safety issues. Confirm that racks, patch panels, and metallic containment are correctly bonded according to BS EN standards.

10. Incomplete documentation and handover

Without test results, cable schedules, and layout drawings, future maintenance becomes costly and inefficient. Always insist on complete handover documentation from your cabling provider.

Avoiding these mistakes does not require expensive tools or complex systems, just consistent attention to standards, workmanship, and verification. Quality cabling installation is the foundation of every reliable network, and it starts with getting the basics right.

Contact us today to request a tailored quote for your site.

Behind every successful data centre build is a team that keeps thousands of cables, connections, and schedules perfectly aligned. The performance of the entire facility depends on how well these specialists plan, coordinate, and deliver each stage of installation.

Here is a closer look at the key roles that make structured cabling projects run efficiently and safely, and how they work together to keep timelines and quality on track.

1. Project Manager

The project manager oversees the full delivery of the cabling scope. They coordinate with the main contractor, client representatives, and other trades to align schedules and ensure compliance with all site and safety standards. Strong communication and documentation skills are critical to maintaining control of progress, resources, and risk.

2. Site Supervisor

Acting as the bridge between office planning and on-site activity, the supervisor manages daily operations. They track workforce allocation, sign off work stages, ensure testing and quality standards are met, and resolve logistical challenges as they appear.

3. Cabling Engineers and Technicians

These are the skilled hands behind the work. Cabling engineers handle installation, termination, and testing of copper and fibre systems. Their expertise ensures each link performs to specification and that cabling is routed neatly, labelled correctly, and tested to the right standards.

4. Fibre Splicers

As data centres grow more fibre-dense, splicers play a crucial role in achieving low-loss, high-speed connections. They prepare fibre strands, perform precision splicing, and validate performance through optical time-domain reflectometer (OTDR) testing.

5. Test and Commissioning Engineers

Once installation is complete, testing verifies that every cable meets specification. Commissioning engineers use calibrated equipment such as Fluke DSX or OTDR testers to confirm continuity, attenuation, and compliance with ISO/IEC and EN standards. Their reports form part of the project’s final documentation package.

6. Health and Safety Lead

Data centre environments have strict compliance requirements. The H&S lead ensures safe working practices, maintains risk assessments and method statements, and enforces the use of personal protective equipment (PPE) and site protocols. They also brief new team members and monitor ongoing adherence to site-specific rules.

7. Quality Assurance Coordinator

Quality control is critical for repeatability and reliability. QA coordinators audit installation work, verify test results, and maintain documentation consistency. They help identify potential issues early, preventing costly rework or handover delays.

8. Logistics and Materials Coordinator

With hundreds of reels of cable, patch panels, trays, and consumables, logistics management can make or break project flow. This role tracks deliveries, manages on-site storage, and ensures teams always have the right materials available without causing congestion or safety hazards.

9. Client or Consultant Representative

On larger projects, an external consultant or client representative often reviews progress, compliance, and testing results. Collaboration between this stakeholder and the project team ensures transparency and trust throughout delivery.

10. Administrative Support

While often behind the scenes, project administrators manage document control, test result compilation, and reporting. Their accuracy and organisation keep the entire process traceable from start to finish.

A successful data centre cabling project depends on the coordination of many specialised roles working toward the same goal: delivering a safe, efficient, and fully certified network infrastructure. Investing in skilled teams, clear communication, and structured project management keeps every link strong, from planning to handover.

Get in touch today to discuss your next project.

If you are planning a network cabling installation or upgrade in London, one of the first questions is always: how much will it cost? The answer is not straightforward. Cabling projects involve many variables, and no two sites are exactly alike.

Rather than chasing a fixed “per-point” number, it is better to understand the factors that influence your quote. This way, you can compare suppliers fairly, spot hidden extras, and make an informed decision.

The Key Factors That Influence Cabling Costs

1. Site Type and Building Layout

- New builds and open-plan offices are usually more straightforward, with easier access for cable routes.

- Older buildings or heritage sites often involve restricted spaces, thick walls, or tricky ceiling voids, all of which increase labour time.

2. Working Hours

- Standard business hours are typically the most cost-effective.

- Out-of-hours work (evenings, weekends) may be necessary in live environments such as retail or hospitality, and this raises labour costs.

3. Access and Location in London

London brings its own challenges:

- Parking restrictions, congestion zone charges, and security clearances can all add cost.

- Multi-storey buildings with limited riser or comms room access also take longer to cable.

4. Scope of Work

Quotes can vary depending on what is included:

- Number of outlets or cable runs required

- Patch panels, racks, and termination work

- Testing and certification (Fluke reports)

- Documentation, labelling, and handover packs

Always confirm whether these are included, as they make a big difference to project value.

5. Cable Category and Performance Requirements

- Cat5e vs Cat6 vs Cat6a vs fibre will influence both labour techniques and required testing.

- Higher categories typically involve stricter installation practices, longer testing times, and sometimes specialist skills.

Common Hidden Costs to Watch For

When comparing quotes, make sure you check for:

- Parking, congestion charge, or travel fees in London

- Out-of-hours premiums

- Testing and certification (sometimes treated as an extra)

- Patch panels, trays, or fixings not itemised in the original quote

- Documentation and as-built drawings

A “cheaper” quote without these items may end up costing more in the long run.

Best Practices for Getting a Reliable Quote

- Request a detailed breakdown separating labour and materials.

- Ask if testing, documentation, and warranties are included.

- Provide as much site information as possible upfront to avoid surprises later.

- Choose a partner who follows structured cabling standards and provides Fluke-tested results.

Trends Shaping Network Cabling in London

These are some of the developments that we are seeing in demand and shaping how network cabling services are delivered:

- Higher Cable Categories

- Growing preference for Cat6a and fibre backbones due to bandwidth and reliability demands.

- Older Cat5e installations are increasingly seen as short-term or legacy.

- Growing preference for Cat6a and fibre backbones due to bandwidth and reliability demands.

- Stricter Standards and Testing

- Clients expect full performance verification (cable tests, performance reports).

- Greater emphasis on cable management, labelling, compliance with structured cabling standards.

- Clients expect full performance verification (cable tests, performance reports).

- Retrofitting & Upgrades

- Many London buildings are older; upgrades rather than new build are common.

- Retrofitting structured cabling while working around existing infrastructure is a growing skill demand.

- Many London buildings are older; upgrades rather than new build are common.

- Service & Support Value

- Businesses are choosing contractors who provide not just installation, but ongoing support (maintenance, future expansions).

- Businesses are choosing contractors who provide not just installation, but ongoing support (maintenance, future expansions).

- Sustainability / Efficiency Considerations (based on industry trends)

- Reducing waste, using better materials, more organised cable routing for energy efficiency (e.g., better airflow).

- Reducing waste, using better materials, more organised cable routing for energy efficiency (e.g., better airflow).

Network cabling in London comes with unique challenges, from building layouts to congestion charges. Costs can vary widely, but by understanding the factors that shape your quote, you can avoid hidden extras and make a better investment decision.

At iCobus, we believe in transparency and best practice. Every project we deliver is tested, certified, and documented, so you know exactly what you are paying for — and why. Contact us today to request a tailored quote for your site.

A reliable ICT network starts with structured cabling. But with multiple international standards — ISO/IEC, EN, and TIA — it can be confusing to know which apply to your project.

This guide breaks down the main standards, explains why they matter, and shows how following them ensures your cabling system is compliant, future-proof, and high performing.

Why Cabling Standards Matter

Structured cabling is more than just cables and connectors — it’s a framework of design rules, performance benchmarks, and compliance checks.

Standards exist to:

- Ensure interoperability across manufacturers and systems

- Guarantee performance levels (bandwidth, crosstalk, latency)

- Support future technologies (IoT, AI, new device types)

- Protect your investment with longer lifecycle and warranties

As we often stress to clients, working to standards is what allows installations to be certified and backed by manufacturer warranties.

The Main Standards Explained

1. ISO/IEC 11801

- A global standard for structured cabling.

- Defines requirements for copper and fibre optic cabling across offices, data centres, and industrial sites.

- Covers categories (Cat5e, Cat6, Cat6a, etc.) and performance levels.

2. EN 50173 (European Standard)

- The European adoption of ISO/IEC 11801.

- Applies to UK and EU projects.

- Ensures compliance with EU regulations and interoperability across European markets.

3. TIA/EIA 568 (North American Standard)

- The US standard, but widely referenced worldwide.

- Covers cable categories, pathways, connectors, and installation practices.

- Often used as a benchmark in multi-national rollouts.

How Standards Affect Your Cabling Choices

- Cable Category

- Cat5e, Cat6, Cat6a: each defined by performance levels in standards.

- For new installs, best practice is to choose Cat6a or fibre for future-proofing.

- Cat5e, Cat6, Cat6a: each defined by performance levels in standards.

- Performance Testing

- Standards require links to be tested (Fluke/OTDR for fibre).

- We always deliver certified results so systems meet these requirements.

- Standards require links to be tested (Fluke/OTDR for fibre).

- Documentation & Labelling

- Proper labelling, patching schedules, and as-built drawings are part of compliance.

- This also saves cost in long-term maintenance and troubleshooting.

- Proper labelling, patching schedules, and as-built drawings are part of compliance.

- Warranties & Compliance

- Only standards-compliant installs qualify for manufacturer-backed warranties.

- This protects your infrastructure investment for 15–25 years.

- Only standards-compliant installs qualify for manufacturer-backed warranties.

Benefits of Standards-Compliant Cabling

- Future-Proofing → ready for next-gen devices and bandwidth.

- Scalability → adding devices and users without major redesigns.

- Reliability → fewer failures, downtime, and troubleshooting.

- Compliance → meeting building codes, safety, and warranty requirements.

FAQs on Structured Cabling Standards

Q: Do I need to know all three standards?

If your business operates in the UK, EN 50173 is your baseline, aligned with ISO/IEC 11801. If you work internationally, TIA/EIA 568 may also apply.

Q: Which standard should I follow for my office?

Most UK projects follow EN 50173, but we ensure compliance with both European and international benchmarks.

Q: What happens if my installation doesn’t follow standards?

You risk poor performance, lack of warranty coverage, and higher long-term costs.

Structured cabling standards like ISO/IEC, EN, and TIA may seem technical, but they exist to protect your investment and guarantee performance.

We design and install standards-compliant structured cabling systems, delivering Fluke-tested results and manufacturer-backed warranties. Get in touch today to discuss your project.

As technology evolves, so do the demands placed on ICT infrastructure. Businesses today aren’t just thinking about speed and connectivity — they’re also considering efficiency, scalability, and lifecycle value.

That’s why the conversation has shifted from simply installing a cabling system to building a future-ready infrastructure that can handle tomorrow’s power levels, bandwidth, and devices.

Testing, Certification & Reliability

No structured cabling installation is truly future-ready unless it has been properly tested and certified.

At iCobus, every project includes:

- Fluke testing to guarantee performance of every installed link

- Manufacturer-backed warranties that protect your investment long-term

- As-built documentation and certification reports for compliance and ongoing maintenance

This ensures your infrastructure doesn’t just meet today’s requirements, but continues to deliver reliable performance as new technologies emerge.

Higher Bandwidth Standards (Cat6a & Fibre)

Legacy Cat5e and Cat6 systems are still in use, but Cat6a and fibre optic cabling are quickly becoming the default choice for new projects.

- Cat6a: Supports 10 Gbps up to 100m (per industry standards), providing long-term capacity for bandwidth-heavy environments.

- Fibre: Essential in data centres and high-performance networks, offering speed, low latency, and resilience.

Choosing higher-spec cabling today prevents costly rip-and-replace jobs tomorrow — extending the system’s lifecycle and reducing waste.

Smarter Cable Management in Data Centres

Cabling design isn’t only about performance — it also affects cooling and energy efficiency.

- Well-organised cabling allows for better airflow around racks.

- Reduced hot spots mean lower cooling costs and improved system reliability.

- Proper labelling and documentation make ongoing maintenance faster, reducing downtime.

As highlighted in iCobus’s insights on data centre cable management, neat, standards-driven installation is both a performance and an efficiency win.

Designing for Scalability

Future-ready infrastructure is about more than today’s requirements. A well-planned system should:

- Provide room for growth (additional racks, fibre backbones, or new device types).

- Anticipate IoT and AI workloads, which will demand higher density and bandwidth.

- Deliver certified performance through Fluke testing and manufacturer warranties.

The result is an installation that lasts longer, performs better, and requires fewer disruptive upgrades.

Sustainable cabling isn’t just about being “green” — it’s about efficiency, scalability, and smart design. By adopting trends like PoE, Cat6a/fibre backbones, and intelligent cable management, businesses can build ICT infrastructures that are:

- High-performance today

- Flexible for tomorrow

- Efficient over the long term

At iCobus, we deliver structured cabling systems that are certified, future-proof, and designed for evolving technologies. Contact us today to learn more.

When it comes to building a reliable ICT infrastructure, the type of cabling you choose matters. In 2025, most UK businesses upgrading their networks still face a common question: should we stick with Cat5e, move to Cat6, or future-proof with Cat6a?

Each standard has its strengths, costs, and use cases. This guide will break down the differences between Cat5e, Cat6, and Cat6a, explain where each is most suitable, and help you decide the right cabling for your next project.

What Is Cat5e?

Cat5e (“enhanced Category 5”) has been the most widely installed cable type for the past two decades.

- Bandwidth: typically specified at up to 100 MHz in industry standards

- Speeds supported: up to 1 Gbps (Gigabit Ethernet)

- Maximum distance: 100 metres

- Typical use: small businesses, residential installs, legacy networks

While Cat5e is cost-effective, in 2025 it is no longer considered future-ready, especially as most businesses demand speeds beyond 1 Gbps.

What Is Cat6?

Cat6 cabling was introduced to support faster transmission and reduce interference.

- Bandwidth: typically specified at up to 250 MHz

- Speeds supported: up to 10 Gbps (limited to ~55 metres, per industry standards)

- Maximum distance: 100 metres at 1 Gbps

- Typical use: modern offices, schools, retail networks

Cat6 offers a balance between cost and performance, but its distance limitations at 10 Gbps mean it’s not always the best long-term choice for high-performance environments.

What Is Cat6a?

Cat6a (“augmented Category 6”) builds on Cat6 to deliver higher performance and better shielding.

- Bandwidth: typically specified at up to 500 MHz

- Speeds supported: 10 Gbps up to 100 metres (per industry standards)

- Shielding: improved to reduce crosstalk and interference

- Typical use: data centres, enterprise networks, environments using PoE/PoE+ devices

Cat6a is the preferred option for new structured cabling installs in 2025, especially for businesses aiming to future-proof their infrastructure.

Cat5e vs Cat6 vs Cat6a: Quick Comparison

Which Cable Should You Choose in 2025?

- Choose Cat5e if you’re maintaining an existing small network with limited performance needs.

- Choose Cat6 if you want a step up from Cat5e and are working within a budget, but don’t need 10 Gbps across full 100m runs.

- Choose Cat6a if you want true future-proofing, are supporting bandwidth-heavy apps, or running multi-site enterprise installations.

Common Questions (FAQs)

Q: Is Cat5e still good in 2025?

It works for basic Gigabit networks, but it’s considered outdated for new installations.

Q: Can Cat6 support 10 Gbps?

According to industry standards, yes—but only up to around 55 metres. Beyond that, performance drops.

Q: Why is Cat6a recommended for future installs?

Industry standards specify that Cat6a guarantees 10 Gbps at 100 metres, supports modern PoE devices, and reduces interference in high-density environments.

The cabling standard you choose will directly impact the performance and scalability of your ICT infrastructure. While Cat5e still has a place in legacy systems, Cat6a is now the industry standard for new builds and upgrades in 2025.

If you’re planning an upgrade or large-scale rollout, iCobus can support you with structured cabling design, installation, and end-to-end ICT project delivery across the UK and Europe.

As organisations scale their networks, open new locations, or modernise aging infrastructure, the question is no longer if they need a partner for ICT delivery - it’s who they can trust.

The industry has evolved. Today’s ICT projects are no longer one-off cabling jobs - they’re full-scope infrastructure deployments that span multiple sites, multiple countries, and multiple technologies. And while anyone can install a switch or run a cable, delivering infrastructure at scale - on time, with consistency, and without risk- requires a highly specialised delivery partner.

In this article, we break down what to look for in an ICT rollout partner in 2025, drawing on trends, best practices, and the lessons learned from thousands of installations across the UK and Europe.

Why the Right ICT Rollout Partner Matters More Than Ever

The stakes have changed:

- Hybrid working has made WiFi coverage, security, and device management critical.

- Retail and hospitality brands are undergoing mass digital upgrades across hundreds of physical locations.

- Data centre expansion is booming across Europe, requiring exacting standards for fibre, BMS, and server deployment.

All of this means organisations need ICT rollout partners who can do more than deliver engineers. They need:

- End-to-end coordination

- Geographic reach

- Regulatory compliance

- Remote project oversight

- Warranty-backed quality control

What Defines a Best-in-Class ICT Rollout Partner?

Here’s what separates a high-trust delivery partner from a body shop or subcontractor chain.

1. Integrated Service Offering

A true ICT rollout partner should offer end-to-end infrastructure services - not just headcount.

Look for providers who cover:

- Structured data cabling (CAT6, CAT6A, CAT7)

- Fibre optic installation, splicing, and testing

- WiFi access point deployment across single/multi-site networks

- IT equipment installation: racking, stacking, patching

- Security systems: CCTV, access control, monitoring

- Project Management Office (PMO) oversight

Why it matters: Fragmented suppliers create risk. Integration ensures consistency.

2. Proven Experience Across Multiple Industries

ICT infrastructure doesn’t exist in a vacuum. A partner should demonstrate successful delivery in your sector context:

- In retail & hospitality, they should have delivered multi-site rollouts with live trading environments.

- In data centres, they should understand airflow, rack weight tolerances, and compliance reporting.

- In offices, they should support AV, access control, hot-desking, and wireless design.

- In residential or MDU environments, they should be fluent in WiFi mesh, powerline, and remote monitoring.

Ask: “Can you share anonymised examples of projects like ours?”

3. Documented QA Process & Warranty Options

Top-tier partners don’t just finish projects - they sign off on them confidently.

- Check that their work is backed by manufacturer warranties (e.g., 25-year coverage for cabling and performance).

- Ensure they follow documented QA signoff procedures, including as-built drawings and test reports.

Look for: Certification capabilities (Fluke testing, fibre OTDR reports), and QA documentation standards.

4. Geographic Reach with Centralised Oversight

If you're rolling out across 20 or 200 sites, your partner should be able to scale without degrading quality.

- Can they deploy in every region of the UK?

- Can they operate across Ireland and mainland Europe?

- Do they have an internal Project Management Office (PMO) to remotely oversee teams and track progress?

What to ask: “What’s your average delivery window across UK + EU sites? How do you track performance?”

Related Reading

For a deeper dive into how iMS delivers rollout projects across Europe, see:

→ How iMS Executes ICT Infrastructure Projects Across the UK & Europe →

What Happens When You Choose the Wrong Partner?

Here’s what we see from failed projects:

- Engineers show up with no materials

- Jobs delayed due to lack of RAMS or induction clearance

- No project lead assigned, so no accountability

- Handover is incomplete or undocumented

- Scope creep leads to re-quotes and spiralling costs

For mission-critical projects, this isn’t just frustrating - it’s expensive.

💡 Reality check: If your ICT partner’s quote looks cheap, ask what’s not included. Often, the coordination, testing, and handover are missing - and you’ll pay for it later.

iMS: A Trusted ICT Rollout Partner for the UK & Europe

At iMS (iCobus Managed Services), we deliver ICT infrastructure projects across sectors and borders with:

- End-to-end coverage: design, installation, QA, and support

- Remote PMO oversight to coordinate large-scale rollouts

- Vetted engineers operating across the UK, Ireland, and Europe

- Warranty-backed installations with full compliance

- Over 25 years of experience across structured cabling, fibre, WiFi, and more

From national retailers to high-security data environments, our team is trusted to deliver infrastructure without disruption.

📈 Recent examples include:

- A 1,500-site router and cabling deployment for a major high street brand

- Multi-floor data centre fit-outs across London and Berlin

- Nationwide rollouts of access control systems for enterprise clients

All executed with central oversight, QA controls, and fixed pricing.

📞 Planning an ICT Rollout?

Whether you're expanding to new sites, upgrading ageing networks, or delivering smart infrastructure at scale, the partner you choose will define the outcome.

Speak to the iMS team about how we can support your rollout across the UK and Europe.

📧 Email: stefan@icobus.com

📞 Call: +44 20 8544 0944

When delivering mission-critical infrastructure - whether for a single data centre or 1,600 retail locations - precision matters.

That’s why leading organisations across the UK and Europe partner with iCobus Managed Services (iMS): a proven provider of end-to-end ICT infrastructure services with over 25 years of delivery experience.

From structured cabling and fibre optics to multi-site WiFi deployments and IT hardware installation, iMS provides fully managed, fixed-price project delivery - on time, on budget, and without disruption.

This article explores what modern ICT infrastructure projects require, and how the iMS model provides consistency and confidence from the first site survey to final sign-off

What Are ICT Infrastructure Services?

ICT infrastructure services refer to the systems and installations that power modern digital environments - spanning connectivity, control, and communication.

These services include:

- Structured cabling installation (CAT6A, fibre, coaxial)

- Fibre optic deployment and splicing

- WiFi access point and controller rollouts

- CCTV, access control, and physical security integration

- Building Management System (BMS) and Project Management System (PMS) monitoring

- IT hardware setup (racking, stacking, patching, migration support)

At iMS, these services are delivered through a single, accountable partner, removing the complexity of coordinating multiple subcontractors, suppliers, and schedules.

ICT Project Delivery: Why the Traditional Model Falls Short

In most organisations, ICT projects are still delivered using a patchwork of external vendors - often resulting in:

- Misaligned scheduling and site access

- Inconsistent engineering quality

- Poor communication across trades

- Cost overruns due to scope gaps or delays

- Missed compliance or QA standards

This fragmented approach is particularly problematic for multi-site deployments, where tight timelines, brand standards, and minimal disruption are critical.

The iMS Alternative: Full-Service ICT Delivery

iCobus Managed Services (iMS) offers a different model: a comprehensive delivery partner for all aspects of ICT infrastructure.

We manage:

- Site surveys

- System design and quoting

- Engineering labour

- Materials procurement

- Remote project management

- Quality assurance and handover

The result: a single point of contact, consistent standards, and guaranteed delivery - whether it's a data centre or a 1,600-site rollout across the UK.

iMS is the delivery partner behind some of the UK’s most complex ICT projects, including the installation of 5G routers and CAT6A cabling in a UK Coffee Chain’s nationwide stores

Core Capabilities: What iMS Delivers

Structured Cabling Systems

Installation of copper and fibre cabling for internet, security, WiFi, access control, and environmental monitoring - executed to the highest industry standards.

Fibre Optic Deployment

Splicing, testing, and certification of fibre installations to support high-bandwidth environments. iMS ensures every connection meets the specifications required for latency-sensitive environments.

WiFi Installations (Single & Multi-Site)

From office floors to national retail chains, iMS designs and installs robust WiFi infrastructure, managed remotely by our central PMO.

IT Hardware & Network Services

Skilled field engineers deliver racking, stacking, and patching of switches and servers, ideal for data centre expansions and network migrations.

Security Infrastructure

Integrated access control, CCTV, and monitoring systems as part of wider structured cabling deployments or stand-alone upgrades.

Geographic Reach: UK + Europe

With registered entities in the United Kingdom, Ireland, and South Africa, and a team experienced in international logistics and compliance, iMS delivers across:

- 🇬🇧 United Kingdom (nationwide)

- 🇮🇪 Ireland – Dublin

- 🇩🇪 Germany – Berlin, Hamburg, Munich

- 🇫🇷 France – Paris

- 🇳🇱 Netherlands – Amsterdam

- 🇪🇸 Spain – Madrid, Barcelona

- 🇸🇪 Sweden – Stockholm

- 🇵🇱 Poland – Warsaw

- 🇨🇿 Czech Republic – Prague

- 🇩🇰 Denmark – Copenhagen

Whether you’re opening a new facility, rolling out a service network, or upgrading a continent-wide estate, iMS can deploy with consistency at scale.

Case Example: Nationwide Multi-Site WiFi Rollout

One recent project involved a nationwide rollout of 5G routers and CAT6A cabling across over 1,600 high street retail locations in the UK.

Project Requirements:

- Completion within strict timelines

- Site access coordinated around business hours

- Zero disruption to daily operations

- Consistent install quality across all regions

iMS coordinated:

- All engineering teams

- Material procurement and direct-to-site logistics

- Remote PMO oversight for scheduling, live reporting, and quality control

iMS coordinated all engineering teams, delivered materials directly, and remotely managed scheduling and reporting through our PMO - completing the full rollout without business disruption.

This same approach has been applied across data centre networks, office reconfigurations, and multi-country retail estate upgrades.

Why Clients Choose iMS

Feature

Traditional ICT Contractors

iMS (Managed Services Model)

Engineering

Varies by subcontractor

In-house and vetted delivery teams

Accountability

Multiple points of contact

One accountable partner

PM Oversight

Often missing or informal

Formal remote PMO reporting daily

Quality Assurance

Ad hoc

Documented QA processes and client sign-off

Warranty

Varies by vendor

Manufacturer-backed (up to 25 years)

Geographic Consistency

Limited to regions

Nationwide + EU coverage

Related Resources

- Structured Cabling Installation Services →

- View Our IMS Brochure → iCobuss Managed Services (IMS)

- Get in Touch →

📞 Thinking About Your Next ICT Project?

Whether you’re rolling out fibre at a single data centre or deploying new connectivity infrastructure across a network of sites, iMS provides the planning, execution, and accountability needed to ensure project success.

To speak with our team or request a tailored quote:

📧 Email stefan@icobus.com

📞 Call +44 20 8544 0944

Let us take your ICT infrastructure from blueprint to handover - with clarity, speed, and precision.

In our increasingly digital world, technology’s rapid evolution is reminiscent of Moore’s Law, with computational power expanding exponentially. It’s almost bewildering to consider that merely a decade ago, we were witnessing the launch of the first iPad. Today, we navigate a technological landscape that would have seemed almost fantastical back then.

While recent years have seen a shift towards wireless technology in business operations, the importance of structured cabling systems cannot be overstated. These systems remain the cornerstone of your company’s infrastructure, providing the foundation for all communication, be it data transmission, voice, or video signals. Despite the convenience of wireless technology, structured cabling offers a level of security and robustness that is unparalleled in the IT sector.

So, why exactly is structured cabling so critical to your business? Let’s explore this in more detail.

Understanding Structured Cabling

Structured cabling is an organised approach to your business’s digital infrastructure. It’s a system that streamlines your data, voice, video, and other management systems, such as security access and alarms.

What is Structured Cabling?

Structured cabling comprises:

- A set of cables

- Connectors

- Devices

These components work together to enable communication between different network devices and computer systems.

In a structured cabling system, all the devices within an organisation are linked using a standardised architecture. The system can be divided into smaller sections, each with its own purpose, and they can be managed independently. This modular approach allows for easier troubleshooting and maintenance, leading to a highly efficient IT setup.

The Role of Structured Cabling in the IT Sector

But what role does structured cabling play in the IT sector? Its importance cannot be understated.

Data Transmission and Communication: In the IT sector, where data transmission and communication are fundamental, structured cabling serves as the backbone of operations. It helps create a reliable and robust network system that allows for efficient data exchange, quicker problem resolution, and reduced downtime.

Flexibility and Adaptability: Structured cabling solutions offer a level of flexibility that makes it easy to adapt to the evolving needs of a business. Whether it’s the addition of new devices or changes in the system configuration, a structured cabling system can easily accommodate these changes. This adaptability is a significant advantage in the fast-paced IT sector, where staying up-to-date with technological advancements is paramount.

Why is Structured Cabling Important?

Understanding the concept of structured cabling is one thing, but truly appreciating its value requires a look at the unique benefits it brings to IT operations. The simplicity, efficiency, and flexibility offered by structured cabling are invaluable assets to any business.

Simplicity: Streamlining IT Operations

One of the most significant advantages of structured cabling is the simplicity it introduces. In a digital environment where various devices and IT equipment are in operation simultaneously, managing these diverse elements can become a complex task.

- Organisation: Structured cabling brings an unprecedented level of organisation to your IT infrastructure. By unifying your IT network under a single system, it effectively eliminates the complications associated with having multiple wiring infrastructures in one place.

- Troubleshooting: With a unified system, identifying and resolving issues becomes a less daunting task. Instead of trying to navigate a labyrinth of disparate cables, your IT team can quickly locate and address the problem, resulting in minimal disruptions to your operations.

Efficiency: Minimising Downtime

The increased efficiency that structured cabling brings cannot be overstated.

- Reduced Downtime: Structured cabling’s organised nature makes it much easier to identify and solve connectivity problems, thereby reducing downtime significantly. In an unstructured network, you could spend an inordinate amount of time trying to locate the problematic cable. This not only affects productivity but could also impact your revenue if your team has to wait until network troubleshooting is complete.

- Improved Productivity: With structured cabling, problems are resolved quickly, ensuring your business operations continue to run smoothly and productivity levels remain high.

Flexibility: Adapting to Business Growth

Structured cabling is not only about managing your current IT infrastructure; it’s also about preparing for the future.

- Scalability: A structured cabling system offers superior flexibility and scalability, quickly accommodating new changes, additions, or moves. This adaptability ensures improved performance and facilitates business growth.

- Future-proofing: It also reduces the time taken during installation and increases adaptability to network infrastructure changes, making it easier to relocate or upgrade your systems as your business evolves.

Latest Trends in Structured Cabling

As the world becomes increasingly interconnected and data-driven, the structured cabling industry is continuously evolving to keep pace. Here are some of the latest trends shaping the future of structured cabling:

1. High-Speed Connectivity Solutions

Firms like Fischer Connectors are developing high-speed data and power connectivity solutions that combine Single Pair Ethernet and USB 3.2 Gen 2 high-speed protocols. These technologies incorporate the rugged, high-density, and miniature features of their flagship product lines. They enable space-saving and cost-efficient integration in various sectors, including industrial automation and robotics, chemical plants, food processing, automotive production lines, outdoor sensing, and unmanned systems.

2. Increased Data Speeds

The demand for faster data processing and communication has never been higher. Major hyperscale and cloud data centres such as AWS, Google Cloud, Meta, Microsoft Azure, and Equinix have quickly migrated to 400 Gigabit speeds for switch-to-switch links and data centre interconnects. These data centres are now preparing to deploy 800 Gig and looking ahead to 1.6 and 3.2 Terabit speeds. Importantly, these faster data speeds are also beginning to appear in large and even mid-sized hosted and enterprise data centres.

3. Edge Networking

The deployment and maintenance of edge data centres require a specific focus on both the communications infrastructure and the equipment that houses and protects that infrastructure. Edge networking acknowledges that “edge” can mean different things to different users. It provides practical information about the edge’s place in the larger network landscape and offers guidance on deploying the right solution for users’ needs.

4. Single Pair Ethernet (SPE) Devices

Microchip has introduced a range of industrial-grade Single Pair Ethernet (SPE) devices for IIoT and industrial Operational Technology (OT) networks. These devices are designed for low-speed Ethernet edge devices and offer a simplified cabling infrastructure for latency-sensitive applications.

5. Moving to the Edge of the Network

In today’s hyper-connected world, companies need a way to scale and analyse data faster, cheaper, and more effectively. The best way to achieve this is to move out of the cloud and onto the edge of the network, where most of the future data will be generated, analysed, and processed.

How iCobus Can Help?

Navigating the dynamic field of IT and structured cabling calls for the right talent, which is where iCobus comes in. As a recruitment agency specialising in the IT sector, we’ve built an extensive network, collaborating with key figures in this field.

Whether you’re a business seeking skilled professionals or an individual looking for opportunities in structured cabling, iCobus is here to assist. Let’s walk this path together.

Conclusion

In the ever-evolving landscape of information technology, structured cabling stands as a cornerstone, underpinning a vast array of functions. It provides the backbone for transmitting data, voice, alarm, video, or signals, securing business operations and enhancing productivity.

Remember, the benefits of structured cabling extend beyond just straightforwardness and simplicity. It also offers superior efficiency, reducing downtime and troubleshooting complexities, along with the flexibility to accommodate changes swiftly. Plus, with the latest trends driving the field, structured cabling continues to be an area of high importance and strategic interest.

iCobus is here to help you find the right talent that understands and appreciates the significance of structured cabling. We strive to connect businesses with professionals equipped to handle the challenges and opportunities presented by this essential IT component.

So, if you’re ready to solidify your structured cabling capabilities, don’t hesitate to get in touch with us. At iCobus, we’re prepared to guide you through your recruitment journey, ensuring you secure the professionals who can navigate your business through the complex world of structured cabling. Let’s embrace the future of IT together.

Frequently Asked Questions

Why is structured cabling important?

Structured cabling is important because it provides an organised, predictable, and easy-to-manage system for your network infrastructure. It allows for the efficient transmission of data, voice, video, and other signals, and it simplifies troubleshooting, leading to reduced downtime. Its flexibility allows for easy additions and changes, supporting business growth.

Why is it important to use a structured cabling standard?

Using a structured cabling standard is crucial as it ensures that your cabling system is designed and installed according to internationally recognized best practices. This not only provides assurance of the system’s reliability and performance but also ensures that the system is future-proofed and can accommodate advancements in technology without requiring a complete overhaul.

Why is it important to use a structured cabling standard when installing cabling systems?

Adherence to structured cabling standards during installation guarantees that the system will function as intended. The standards guide the planning, installation, and configuration of the cabling infrastructure, promoting consistency, performance, and safety. A properly installed structured cabling system can support a wide range of applications and hardware without needing significant modifications.

Why is it important to use a structured cabling standard when installing and managing cabling systems?

When it comes to managing cabling systems, following structured cabling standards helps maintain the integrity and efficiency of your network. These standards provide a roadmap for routine maintenance, system updates, and troubleshooting. This can result in lower operational costs, less downtime, and a longer lifespan for your network infrastructure.

In today’s fast-paced digital world, seamless and efficient communication is at the heart of numerous operations across sectors such as business, education, healthcare, and entertainment. A crucial yet often overlooked element that enables this vast and intricate information exchange is structured cabling.

What is Structured Cabling?

Structured cabling refers to an organised approach to a building’s or campus’s cabling infrastructure. Instead of tackling each new hardware connectivity requirement individually, structured cabling adopts a comprehensive view

It involves designing and installing systems capable of accommodating changes and additions to hardware and connectivity.

The system is designed to transport data, video, and voice signals. It’s organised into six key components:

- Entrance Facilities

- Equipment Room

- Backbone Cabling

- Telecommunications Room

- Horizontal Cabling

- Work Area

The Importance of Structured Cabling in Modern Communication Systems

The role of structured cabling in contemporary communication systems is crucial. With data speed and volume demands escalating, a robust, efficient, and adaptable cabling infrastructure becomes imperative.

Key advantages of structured cabling include:

- Adaptability: Structured cabling allows businesses to swiftly adjust to new technologies, augment their network’s speed or capacity, or even relocate with relative ease.

- Risk Reduction: Structured cabling minimises downtime risks associated with human error.

Thanks to its organised and clearly labelled system, changes and troubleshooting can be executed quickly with less potential for mistakes.

What are the 6 Components of Structured Cabling?

Component 1: Entrance Facilities